On March 24, the main system changes related to the Ministry of Health, Labor and Welfare to be implemented in April 2020 were announced. In particular, they include a variety of key Employment and Labor Relations systems, and all employers in Japan must be aware of, adhere to, and understand how to take advantage of the changes. Japan’s Main Fiscal 2023 social welfare, insurance, wage, and pension changes are important for large companies and small.

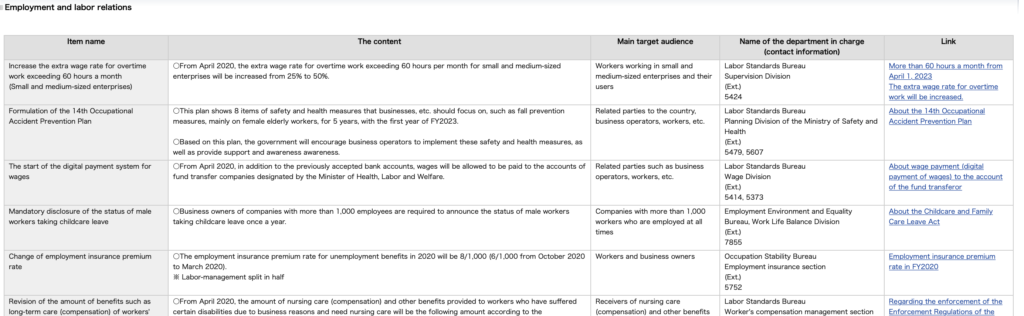

Important changes effective April 2023 impact overtime work, extra wage rate, occupational accident, wage, digital payment, employment insurance premium rate, workers’ compensation insurance, maternal health management, national pension, deferred increase, childbirth, and childcare lump-sum payments.

On the MHLW website, here, you can access the details of all changes, with links to supporting materials and guides, all in Japanese.

Verse Corporation publishes articles on timely issues in Japanese Social Welfare and Labour Law. Japanese payroll, source deductions, and all labor law work & pay rules regarding compensation, social insurance, absenteeism & sick leave, etc. require strict adherence. Labor/employment law can be complex, even for Japanese companies, and must be handled mostly in Japanese. As with all social welfare and labor law matters in Japan, please seek out professional Sharoushi (Certified Labour Law and Social Insurance Attorney.)

Summary of Fiscal 2023 Changes

Increase the extra wage rate for overtime work exceeding 60 hours per month (small and medium-sized enterprises)

Increase the extra wage rate for overtime work exceeding 60 hours per month for small and medium-sized enterprises from 25% to 50%

Formulation of the 14th occupational accident prevention plan. As the first year of FY2023, we have formulated 8 items of safety and health measures that businesses, etc. should focus on for 5 years.

Start of the digital payment system for wages

In addition to the previously accepted bank accounts, wages are allowed to be paid to the account of the fund transfer company designated by the Minister of Health, Labor and Welfare.

Compulsory publication of the status of male workers taking childcare leave. Business owners of companies with more than 1,000 employees are required to announce the status of male workers taking childcare leave once a year.

Change in employment insurance premium rate (general business)

・Employment insurance premium rate related to unemployment benefits: .8%

- Childcare leave benefits: .4%

- Employment insurance for two businesses: .35%

- Total: .155/% (worker burden: .6%, business owner burden: .95/%

Revision of the amount of benefits such as long-term care (compensation) of workers’ compensation insurance (the amount in ( ) is the amount in 2020)

(1) Those who need constant care

・Maximum limit: 172,550 yen per month (171,650 yen)

・Minimum guarantee amount: 77,890 yen per month (75,290 yen)

(2) Those who need nursing care at any time

・Maximum limit: 86,280 yen per month (85,780 yen)

・Minimum guarantee amount: 38,900 yen per month (37,600 yen)

The revised amount of work injury school support expenses and work injury work childcare support expenses (( ) is the amount of FY2020. Other categories are not revised)

(1) Among the work-related accident school support expenses, high schools, etc. (excluding communication system)

・19,000 yen (17,000 yen)

(2) Among the work-related accident school support expenses, high schools, etc. (communication system)

・16,000 yen (14,000 yen)

(3) Among the work-related accident school support expenses, junior high schools, etc. (excluding communication system)

・ 20,000 yen (18,000 yen)

(4) Among the work-related accident school support expenses, junior high school, etc. (communication system)

・17,000 yen (15,000 yen)

(5) Elementary school, etc. among the work injury school support expenses

・15,000 yen (14,000 yen)

(6) Work injury work childcare support expenses

・11,000 yen(13,000 yen)

Extension of the application period of maternal health management measures related to the new coronavirus infection

- The application period that was until March 31, 2023, has been extended until September 30, 2023

Pension-related

Revision of national pension insurance premiums

16,520 yen

Revision of the annual amount

・Those under 67 years old (new arbitrator): 66,250 yen (basic old-age pension (full amount): for 1 person)

→ 2.2% increase from FY2020

・Those who are 68 years old or older (already adjudicated): 66,050 yen (basic old-age pension (full amount): 1 person)

→ 1.9% increase from FY2020

Amount of pensioner support benefits

- The standard amount is 5,140 yen (monthly)

Introduction of a special deferred increase

- If a person who can apply for deferred old-age pension makes a request for a ruling between the age of 70 and under 80 years old (5 years after the occurrence of the right to receive the pension), and does not make a deferred request, the amount will be deferred to the date 5 years before the request for the adjudication request Introduction of a system that is considered to have been made (deferred increase corresponding to benefits that expired from the statute of limitations more than 5 years ago)

Health-Related

Increased amount of lump-sum payment for childbirth and childcare

・Up from 420,000 yen to 500,000 yen

・If you are not covered by the maternity medical compensation system, it will be raised from 408,000 yen to 488,000 yen.

Japan’s Main Fiscal 2023 social welfare, insurance, wage and pension changes are important for large companies and small.

All source information for this article is available, in Japanese, on the MHLW website.

https://www.mhlw.go.jp/stf/seisakunitsuite/bunya/0000198659_00015.html